8 Game-Changing Investment Trends for 2025: Where Smart Money Is Going Now

If you want to grow your money in 2025, it helps to know where the smart money is going. Here are the trends people are watching right now—and how they could affect your choices.

1. AI and Automation Are Changing Everything

AI and robots aren’t just science fiction. They’re real, and they’re making big changes in how companies work.

- AI helps businesses work faster and cheaper.

- Tech companies are investing huge amounts of money into AI.

- Many investors are buying stocks or ETFs that focus on AI.

Look at: Software companies using AI, chipmakers, and tools that help companies automate.

🔗 Learn more: How AI is transforming investing

2. People Want to Invest in What Matters

Sustainable investing—called ESG—is now the standard. People want to support companies that are good for the planet and society.

- New rules are pushing companies to share how they’re doing on ESG.

- Consumers care about climate and fairness.

- ESG investments have held up well, even when markets drop.

Watch for: Clean energy, carbon capture, sustainable farms, and companies with solid ESG scores.

🔗 Related: What Is ESG Investing?

3. Beyond Stocks: Try Something New

People are looking for new ways to invest beyond just stocks and bonds.

- Private equity and venture capital: Risky but with big potential.

- Crypto: Still a rollercoaster, but more companies are using it.

- Real assets: Think farmland or timber.

- Collectibles: Things like art, wine, or sneakers you can invest in.

Tip: Platforms like Fundrise and Yieldstreet make it easy to get started.

4. Playing Defense in Uncertain Times

With prices going up and the world feeling shaky, many are playing it safe.

Safer bets include:

- Healthcare

- Consumer staples

- Utilities

- Stocks that pay regular dividends

Mix in some of these to help protect your money if things get rough.

5. Emerging Markets Might Be Back

Markets in places like Asia, Africa, and Latin America are starting to look good again.

- Interest rates are settling down.

- The U.S. dollar isn’t as strong.

- These countries are growing and using more tech.

How to invest: Try emerging market ETFs or companies doing business there.

Investing for Beginners: How to Start Building Wealth with Just $100

6. Real Estate Still Has Long-Term Value

Even with recent bumps, real estate remains a go-to for long-term growth.

- More people want to live outside big cities.

- Online shopping is boosting demand for warehouses.

- Build-to-rent neighborhoods are popping up.

- REITs let you invest in real estate without buying property.

🔗 Explore: Beginner’s Guide to REITs

7. Fintech Is Changing Banking

Apps and online tools are making money management easier and faster.

- Younger people use digital wallets and neobanks more than traditional banks.

- Old banks are teaming up with fintech companies.

- New tech like DeFi is giving people more control over their money.

Try investing in: Fintech ETFs, payment systems, or blockchain companies.

8. Health Tech and Biotech Are Growing Fast

New tools and medicine are changing how we stay healthy.

- The world is getting older.

- More focus on staying prepared after COVID.

- Personalized medicine and wearables are on the rise.

Consider: Biotech ETFs, health tech startups, or companies using AI in healthcare.

How to Start Investing in These Trends

You don’t have to put all your money into one trend. Spread it out. Learn what fits your goals.

Here’s how:

- Do your homework: Make sure the trend is real, not just hype.

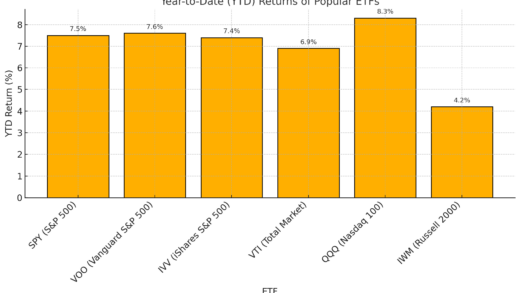

- Use ETFs: They help you invest in a whole group instead of just one stock.

- Check in often: Rebalance every few months.

- Think long term: Look for steady growth, not quick wins.

Don’t chase the latest hot stock. Focus on trends that match where the world is going. That’s how smart investors build real wealth.

Talk to a financial advisor. Start small. The key is to stay informed and stay in the game; keep learning, keep investing.